5. 总结

本文尝试了整合技术、国际贸易和全球价值链文献,并基于当下全球化、生产活动碎片化和无形资产贸易增长的趋势发展出一套整合了产品贸易和无形资产贸易的国际贸易分析框架。通过深入讨论五种无形资产贸易的模式,本文发展出一套基于全球价值链的国际贸易统计框架。把这个框架应用于美国贸易收支计算,我们发现考虑无形资产贸易后, 2016年美国的贸易净收支(包括产品、知识产权、保险和金融服务、计算机通讯和其他服务,以2%收益率和总OFDI和无形资产密集行业FDI历史存量计算的无形资产净收益,以及苹果公司的非美国部分收入)为3963.8亿美元逆差,比 7499.3亿美元仅以产品贸易计算的逆差减少了近一半;2015年美国贸易净收支为3971.5亿美元逆差,而不是7625.7亿美元。如果我们进一步加入除苹果公司外的包含在外包中的无形资产贸易,美国的贸易逆差应当更小。因此,本文认为国际贸易不平衡与相应的政策措施应当基于完整的包括21世纪多种贸易活动在内的统计框架来讨论。

本文的贸易统计框架提供了一种帮助我们理解21世纪更广的贸易图景的方法。产品贸易,甚至产品加服务贸易,不再是描述贸易关系的好的指标。无形资产贸易的各种模式和渠道需要被纳入到这个大的贸易图景中来。一种可能的解决方法是整合数字技术和可靠的公司自申报系统。比如,我们可以用物联网技术链接各种投入和产出,然后用大数据技术对比不同来源数据的准确性和可靠性,以及填补中间的数据空白。而国际合作是建立标准和执行对于新框架的使用和数据收集的可行性和可靠性的重要保障。

本文的研究具有重要的政策意义。第一,本文的研究为如何更好的测度全球化做出了贡献。全球化不应当仅仅根据产品、投资和服务的互动和一体化来测度,还应该包含追踪和测度起来更加复杂的无形资产的流动。

第二,本文为全球化的影响的争论和更包容的全球化政策做出了贡献。近年,全球化被认为是导致发达国家不平等问题的罪魁祸首。反全球化浪潮出现在一些主流的工业化国家。产品的国际贸易成为了攻击对象。贸易和投资保护主义在不断抬头。本文的研究表明全球经济失衡并不像商品贸易所表现出来的那么严重。实际上,工业化国家有巨大的无形资产顺差。但是问题是,无形资产贸易带来的巨大收益集中在少数的所有者和一小部分创造这些无形资产的研究技术人员手里。所以,对于工业化国家来说,无形资产贸易获得巨大利益的团体与社会其他人群之间的是减少不平等的重要措施。并且应当禁止跨境避税行为。

最后,本文的研究对贸易不平衡做出了贡献。我们应该从更加整体的角度,从全球价值链的视角来思考国际贸易的问题。解决工业化国家(如美国)和发展中国家(如中国)之间的贸易不平衡问题的政策工具应当是基于真实的完整的贸易活动。根据本文的分析,中美真实的贸易逆差比大众认知的3570亿美元低很多。因此,减少逆差的谈判基础应当考虑到这个问题。同时,无形资产出口应当被当做一种政策工具纳入两国政府的考量,而不仅仅是高技术产品的出口。

未来的研究应当进一步发展这个基于全球价值链网络的贸易模型,建立必要的数据收集系统、标准和国际数据库,从主要的全球价值链到所有全球价值链,再到所有类型的全球价值链和不基于全球价值链的贸易,分析国家在全球价值链上的位置如何影响他们获取和分享增加值的能力,分享最近的工业革命如何快速的改变全球价值链的形态和国家在其上的位置,以及分析这次工业革命如何影响国家间的价值分配、收入分配、发展中国家的升级,还有分析哪些政策制度对于无形资产和产品整体贸易框架的健康运行是必要的,最后还有分析IPR保护的角色和确保可靠的、有益的数据产生和分享所需的监管。

参考文献

Alcacer,J., & Oxley, J. (2014). Learning by supplying. Strategic ManagementJournal, 35(2), 204-223.

Antràs, P.,(2003). Firms, Contracts, and Trade Structure. The Quarterly Journal ofEconomics, 118(4), pp.1375-1418.

Balassa, B.,(1986). Intra-industry specialization: a cross-country analysis. EuropeanEconomic Review, 30(1), pp.27-42.

Baldwin,R. E., & Evenett, S. J. (2015). Value creation and trade in 21st centurymanufacturing. Journal of Regional Science, 55(1),31-50.

Baldwin, R. andRobert-Nicoud, F., (2014). Trade-in-goods and trade-in-tasks: An integratingframework. Journal of International Economics, 92(1),pp.51-62.

Baldwin, R., and A. Venables (2013): “Spidersand Snakes: Offshoring and Agglomeration in the Global Economy,” Journal ofInternational Economics, 90 (2), 245–254.

Blinder, A. (2006). Offshoring: The Next IndustrialRevolution? Foreign Affairs, 85(2), 113-128. doi:10.2307/20031915

Constantinescu,I. C., Mattoo, A., Mulabdic, A., & Ruta, M. (2018). Global trade watch 2017: trade defies policy uncertainty - will itlast? (English). Washington, D.C.: World Bank Group. http://documents.worldbank.org/curated/en/934031525380654860/Global-trade-watch-2017-trade-defies-policy-uncertainty-will-it-last

Corrado, C. A.,Haskel, J., Jona Lasinio, C., & Iommi, M. (2012). Intangible capital andgrowth in advanced economies: Measurement and comparative results.Publisher:Imperial College Business School, https://spiral.imperial.ac.uk:8443/handle/10044/1/9913

Gereffi, G., Humphrey, J., & Sturgeon, T. (2005).The governance of global value chains. Review of internationalpolitical economy, 12(1), 78-104.

Grossman, G. M., & Rossi-Hansberg, E. (2012). Tasktrade between similar countries.Econometrica, 80(2),593-629.

Grossman, G.M. and Rossi-Hansberg, E., (2008). Tradingtasks: A Simple Theory Of Offshoring. American Economic Review, 98(5),pp.1978-97.

Guvenen, F., Mataloni, R. J., Rassier, D. G., Ruhl, K.J. (2018) ‘Offshore Profit Shifting and Domestic Productivity Measurement’,NBER Working Paper No. 23324.

Haskel, J.,& Westlake, S. (2017). Capitalism without Capital: The Rise of theIntangible Economy. Princeton University Press, Princeton and Oxford.

IMF (2017).Balance of Payment Statistics Yearbook: 2017,International Monetary Fund.

Helpman, E., Krugman, P., 1985.Market Structure and Foreign Trade. MITPress, Cambridge, MA.

Kaplinsky, R.(2000). Globalisation and unequalisation: What can be learned from value chainanalysis? Journal of development studies, 37(2),117-146.

Krugman, P.(1991). Increasing returns and economic geography. Journal of politicaleconomy, 99(3), 483-499.

Krugman, P.R.,1981. Intra-industry Specialization and the Gains from Trade. Journalof Political Economy, 89(5), pp.959-973.

Krugman, P. R.(1979). Increasing returns, monopolistic competition, and internationaltrade. Journal of international Economics, 9(4),469-479.

Krugman,P., Cooper, R. N., & Srinivasan, T. N. (1995). Growing world trade: causesand consequences. Brookings papers on economic activity, 1995(1),327-377.

Lancaster, K.,(1980). Intra-industry Trade Under Perfect Monopolistic Competition. Journalof International Economics, 10(2), pp.151-175.

Leamer, E.(1995). The Heckscher-Ohlin Model in Theory and Practice.International Economics Section, Department of Economics, Princeton University.

Markusen, J.R.and Venables, A.J., (2000). The theory of endowment, intra-industry andmulti-national trade. Journal of International Economics, 52(2),pp.209-234.

Milberg, W. (2004). The changing structure of tradelinked to global production systems: what are the policy implications? InternationalLabour Review, 143(1‐2), 45-90.

Melitz, M.J.,(2003). The impact of trade on intra‐industry reallocations and aggregate industry productivity.Econometrica,71(6), pp.1695-1725.

Moris, F. (2017) Intangibles Trade and MNEs:Supply-Chain Trade in R&D Services and Innovative Subsidiaries, Journal ofIndustry, Competition and Trade, https://doi.org/10.1007/s10842-017-0265-0.

Mu, Q., & Lee, K. (2005). Knowledge diffusion,market segmentation and technological catch-up: The case of the telecommunicationindustry in China. Research policy, 34(6), 759-783.

Mudambi, R. (2008). Location, control and innovationin knowledge-intensive industries. Journalof economic Geography, 8(5), 699-725.

OECD(2013). Interconnected Economies: Benefiting from Global Value Chains.OECD Publishing.

OECD.(2017), OECD Science, Technology and Industry Scoreboard 2017: Thedigital transformation, OECD Publishing, Paris, http://dx.doi.org/10.1787/9789264268821-en.

Reinsdorf,M. B. and Slaughter, M. J. (2009) InternationalTrade in Services and Intangibles in the Era of Globalization, Universityof Chicago Press.

Ricardo, D. (1817). On the Principles ofPolitical Economy and Taxation,London: John Murray.

Rodriguez-Clare, A. (2010). Offshoring in a Ricardian world, AmericanEconomic Journal: Macroeconomics, 2 (2).

Rungi,A., & Del Prete, D. (2018). The smile curve at the firm level: Where valueis added along supply chains. EconomicsLetters, 164, 38-42.

Shih, S. (1992).Empowering technology—making your life easier. Acer’s Report, Acer’s, New Taipei.

Shih, S. (1996).Me-Too Is Not My Style: Challenge Difficulties, Break ThroughBottlenecks, Create Values. The Acer Foundation, Taipei.

Smith, A. (1776).An inquiry into the nature and causes of the wealth of nations. London: George Routledge and Sons.

Sturgeon, T. J. (2001). How do we definevalue chains and production networks? IDS bulletin, 32(3),9-18.

UNCTAD. (2018).Key Statistics and Trendsin International Trade: The Status of World Trade 2017.United Nations: New York and Geneva. http://unctad.org/en/pages/PublicationWebflyer.aspx?publicationid=2109

Venables,A.J., (1999). Fragmentation and multinational production. European EconomicReview. 43, 935–945.

Vernon, R. (1966). InternationalInvestment and International Trade in the Product Cycle. The QuarterlyJournal of Economics, 80(2), 190-207.

Walsh, J. P., Lee, Y. N., & Nagaoka,S. (2016). Openness and innovation in the US: Collaboration form, ideageneration and implementation. Research Policy, 45(8),1660-1671.

WIPO (2017).World Intellectual Property Indicators – 2017, WIPO, Switzerland.

World Bank. (2017). World Bank Annual Report 2017 (English). Washington,D.C.: World Bank Group. http://documents.worldbank.org/curated/en/143021506909711004/World-Bank-Annual-Report-2017

附录

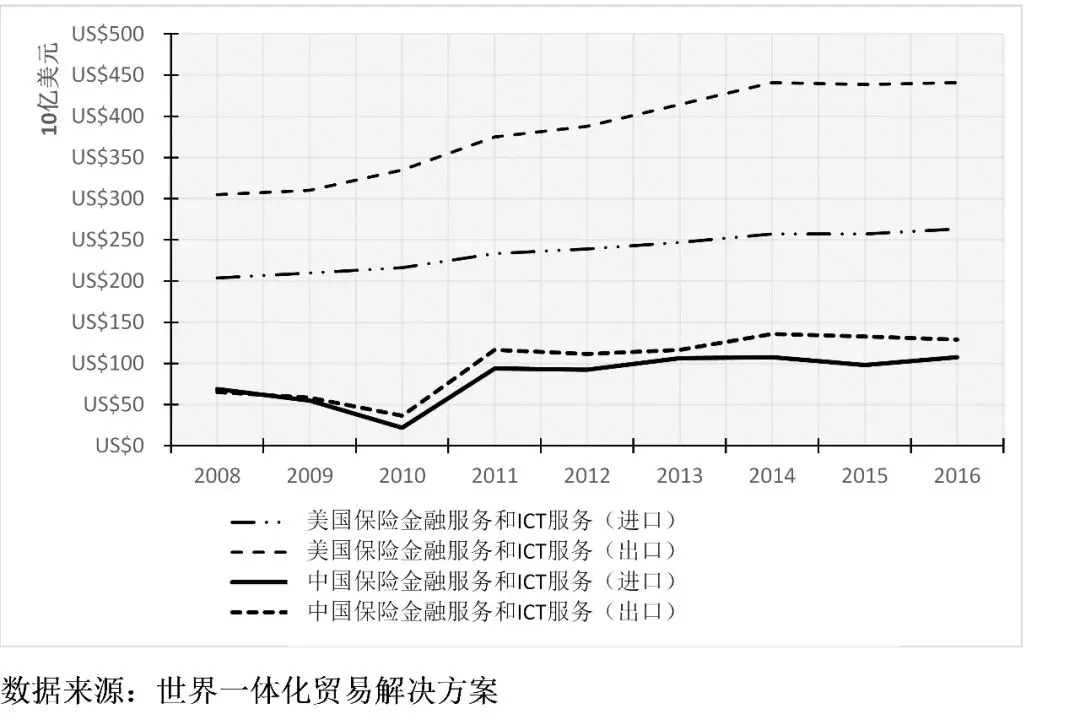

图 1A. 中美保险金融服务和ICT服务

(文章来源:牛津大学技术与管理发展研究中心)